- Products

- Freight Forwarders Liability Insurance

- Marine Cargo Insurance

- Cyber Insurance

- Trade Credit Insurance

- Business Insurance

- Event Insurance

- Product Liability Insurance

- Public Liability Insurance

- Film Insurance

- Group Medical Insurance

- Private Medical Insurance

- Property Insurance

- Group Corporate Travel Insurance

- Key Man Life Insurance

-

Business Insurance

From Sole Traders To The Largest Multinationals - Safeguard Your Business

-

Customs Bonds

Navigating Import Bonds

-

Cyber Insurance

Protect Your Business Against Cyber Threats

-

Directors and Officers Liability Insurance

Protect Your Executives And Board Directors From Risk

-

Event Insurance

Offset Risks For Your Special Event With Multi-Coverage

-

Film Insurance

We've Got The Dynamics Of The Industry Covered

-

Freight Forwarders Liability Insurance

Customized Solutions For Freight And Logistics

-

Group Corporate Travel Insurance

Stay Protected Wherever Business Takes You

-

Group Medical Insurance

A Collective Policy Incorporating Flexible Individualized Benefits

-

High Value Home and Private Collections Insurance

All Risks Property Insurance For High Value Luxury Homes And Contents

-

Jewellers Block Insurance

Protecting the interests of wholesalers, retailers and individual collectors

-

Key Man Life Insurance

Protect The Most Valuable Asset Of Your Company – People

-

Marine Cargo Insurance

All Risks Cover, Place to Place, By Any Transport Mode

-

War Risks Insurance

Provide annual marine war cover, giving the shipowner the freedom to trade globally subject to the latest Joint War Listed Area.

-

Private Medical Insurance

Protecting You Now And Beyond

-

Product Liability Insurance

Customizable Protection Against Product Liability In Manufacturing And Supply

-

Professional Indemnity Insurance

Protect Your Finances And Reputation

-

Project Cargo Insurance

Invaluable Cover For Your Valuable Cargo

-

Property Insurance

Protect Against Losses And Minimize Impact

-

Public Liability Insurance

Solutions For Your Premises Or Business Operations

-

Trade Credit Insurance

Protect Your Receivables

Platform

Solutions

Precise Protection

- Precise Protection

- Industry

- Freight Forwarders, Logistic Companies & Customs House Brokers

- Trading Companies, Import/Exporters, Manufacturers & Sourcing Companies

- Finance Companies, Funds And Fund Managers

- Recruitment Firms

- Business Consultancies & Professional Services Firms

- Healthcare Professional Indemnity Insurance

- Healthcare Veterinarians Professional Indemnity Insurance

- Insights

- About

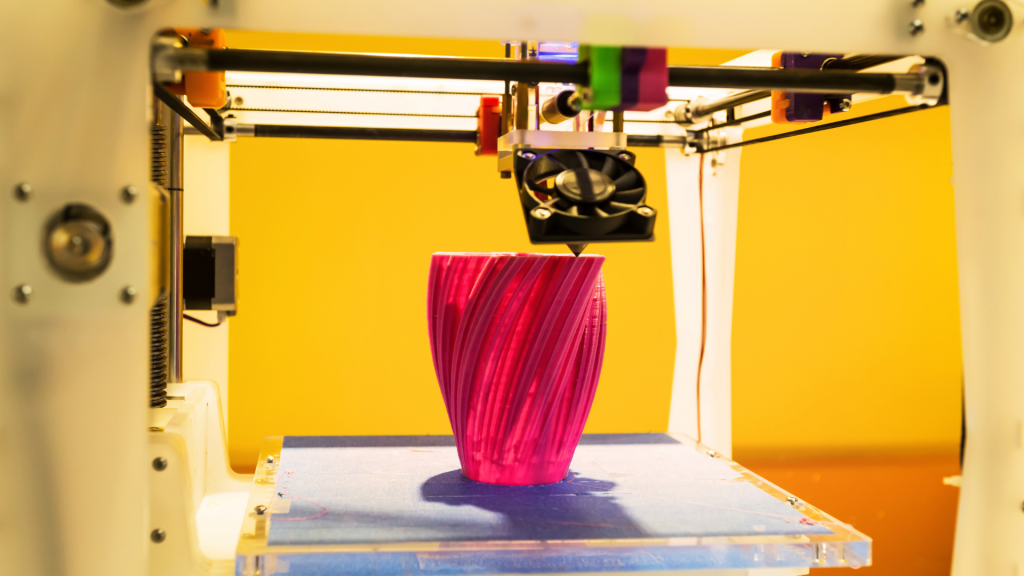

Product Liability

Customizable Protection Against Product Liability In Manufacturing And Supply

Product Liability

What is Product Liability Insurance?

Product Liability Insurance provides cover for claims made against you in connection with a product you have sourced, sold, designed or manufactured that may have caused damage or injury to another person or property.

Do I need Product Liability Insurance?

A manufacturer, supplier, distributor, or retailer may be held liable for bodily injury or damage to property of others caused by defective products. This policy seeks to cover liabilities arising out of the use of a specific product.

Not only is Product Liability Insurance a common vendor requirement for all major retailers, importers and licensors, it can also be viewed as an indicator of responsible due diligence and professionalism in a supply chain.

We’ve seen our client’s turnover soar with what can be considered as a ‘barrier to entry’ removed, and the benefit of it in differentiating a business from similar competitors, and improving entry to distribution channels which otherwise may have been closed.

Looking for Product Liability Insurance?

What does Product Liability Insurance cover?

Our Product Liability Insurance policy covers the insured’s legal liability for bodily injury or property damage caused by a defective product which it has manufactured, distributed, or sold. This includes all costs and expenses incurred in defense of justified and unjustified claims.

Optional extension:

- Advertising injury

- Manufacturing Errors & Omission

- Products recall expenses

With years of experience in both Product and Public Liability Insurance, with Azure Risk you can get your business insurance cover in one place.